CHC shares slide, Milestone buys, Singapore Swings

NOTE: The below originally appeared as the editorial in our July 9 Helicopter Investor News. To find out more, and sign up for free, please click here.

You could, in theory, now buy CHC, one of the world’s largest helicopter operators, for the price of a couple of S-92s. The operator’s share price has fallen sharply in the last few weeks giving it a market capitalization of $50 million (although it is worth remembering that very few shares are actually listed).

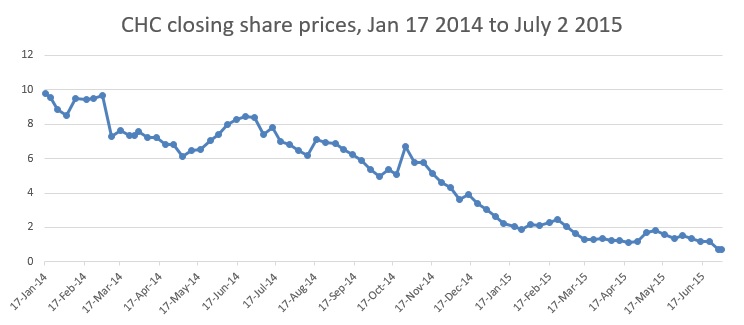

CHC floated on January 17, 2014 at $10 a share (below guidance of $12 to $14). Yesterday it was trading as low as $0.58. Down from $1.22 on Monday June 29.

The shares fell sharply after CHC announced its results for its financial year ending on April 2015.

CHC’s $1.7 billion revenue for the year was up 1% in real terms, but down 3% due to currency changes. The company made a net loss of $805 million, compared to a loss of $173 million in its 2014 financial year. CHC made an adjusted EBITDAR of $461 million for 2015, down from $471 million in 2014 (its adjusted EBITDAR does not include corporate transaction costs).

The operator did have a tough fourth quarter. Revenue fell 17% to $374 million. Operating revenue – which does not include costs charged back to customers – fell from $412 million last year to $345 million. This meant that CHC made a net loss of $119 million for the quarter.

Several law suits have been filed against CHC saying the company should have stated that Petrobras had stopped making payments in April 2013 when it filed its IPO.

Despite these problems,the stock market reaction to CHC’s results is clearly over the top. It has also been exaggerated by the small amount of shares that are listed. Equity analysts also say it is undervalued.

CHC is exposed to oil companies that want to cut costs, but more the 80% of its business is in production, not exploration. It is also worth remembering that CHC owns a lot of helicopters. There is hidden value in its fleet of 233, mostly owned helicopters.

It also has $645 million of liquidity available, allowing it to survive several more years of losses. Most significantly Clayton, Dubilier & Rice has bought into the company and has continued to invest.

Clayton, Dubilier & Rice has brought in a new management team headed by Karl Fessenden who joined in February as CEO. He joined from GE as did Dave Lisbeth, the new SVP for human resources. Lee Eckert will become CFO on July 16, replacing Joan Hooper (this was her last analyst call). Eckert joins from National Grid and also worked at GE. Hooman Yazhari has joined as general counsel. He worked at ILFC and Gate Group.

CHC is cutting costs. It will cut the number of staff it pays by 12% (it spent $36 million on restructuring costs last quarter). The operator is looking to cut non-aircraft costs, fleet maintenance planning, spares inventory and improve helicopter utilization.

In 2015 contracts ended on several helicopters that it had taken on operating lease. It now plans to return these at the end of leases. In its guarded analyst call, CHC said that it would also try to renegotiate lease rates by offering new contracts to lessors.

As well as cutting costs, and trying to reduce CHC’s $1 billion of debt ($2.36 billion including lease rentals), you can be sure that the new ex-GE team are looking at all options.

The most obvious decision would be to sell of divisions – particularly Heli-One, CHC’s maintenance business – and get joint venture partners to buy out partnerships.

But Clayton, Dubilier & Rice did not buy the company to make it smaller. Despite its market capitalization, CHC may be a buyer rather than a target.

Milestone buying again

Although it has been busy slotting into GE Capital Aviation Services (Gecas), Milestone Aviation has been relatively quiet since it was acquired in January. It was clearly only waiting for the Paris Airshow (where GE always has a good chalet).

It placed its first letter of intent with Bell Helicopters ordering 20 Bell 525 Relentless helicopters. It also ordered three AW139s, converting options from its September 2013 order, and ordered 23 new H175s from Airbus Helicopters (it has now ordered 28 H175s in total).

The orders are not a surprise. Milestone is experienced at buying aircraft from and these orders will not be delivered until after 2017. It is also mainly buying later serial numbers to reduce the risk of financing new models. Gecas also likes ordering new aircraft. It ordered 60 A320neos at the airshow (it has now ordered 120 of the type) and announced a new cargo programme.

The Bell 525’s are due for delivery from 2017. “By securing future delivery positions for the Bell 525, we are continuing to demonstrate our strong commitment to that goal,” said Daniel Rosenthal, Milestone’s President.

As well as the orders, Gecas is also investing in people for Milestone. By the end of this year Milestone will have doubled the number of people that work there since it was acquired. Several of these new hires are coming from OEMs. It will have staff in Gecas offices across the world.

Milestone has now placed orders with all of the large helicopter manufacturers. It is Bell’s second lessor order, with Waypoint signing a letter of intent for 20 Bell 525s in March.

Milestone has a fleet of 187 helicopters worth $3.2 billion. It is also well diversified with helicopters on lease to 33 operators in 26 countries. Milestone now has options and orders for 160 helicopters worth $3.2 billion at list price.

Singapore swings

More than 100 of the great and the good in Asia’s helicopter market (including about 15 different operators) gathered in Singapore for Helicopter Investor Asia in June. And they tried hard to be upbeat, despite oil prices.

Operators serving oil and gas companies were refreshingly honest about their markets. Most of them admitted they are under pressure to cut costs and are flying less – in some cases up to 25% less. Some 56% of attendees said that the effects of oil prices have already been felt on helicopter values (despite few trading).

But it was not all doom and gloom. First, utility operators are enjoying lower fuel prices and finding it easier to recruit. Second, there are lots of opportunities to grow across the region.You are probably bored of this, but we should also not write off oil and gas.

Speaking at the conference, James Hearn of Infield Systems forecasts that Asia will be the largest market in terms of rigs by 2016 and have the highest capital expenditure of any region.

Infield estimates that the Asia-Pacific share of off-shore market will rise from 20.4% in 2011 to 20.4% in 2020. It made not sound like a lot but 2% is a lot of helicopters.

Sikorsky à vendre à Paris

Airlines order and new aircraft launches get the biggest headlines at airshows, but as much business gets done between suppliers selling to each other. This year, United Technologies used the Paris Airshow to try and sell Sikorsky. For $4 billion.

Textron, Airbus and others are all rumoured to be interested (although so far the process has been commendably leak free). United Technologies says it will decide on a buyer by September. Reuters says that it is down to Lockheed Martin and Textron but this has not been confirmed.

Several defence companies have been named. If one of these are successful it could be interesting to see how much support is given to commercial helicopter programmes.

The Paris Airshow analyst presentation was pretty downbeat. Sikorsky is forecasting a 20% fall in commercial sales this year (at the start of this year it was expecting a 3% rise). It expects to lose $150 million this year compared to a previous forecast of $25 million. And this is after job cuts.

Gregory Haynes, CEO, of United Technology – and the former CFO – clearly has a vision for the company. But you do wonder if the sale could have been delayed by a year.

Russians in Paris

There is a great (but probably false) theory that French cafes are called bistros because of the Russian invasion in 1814. Cossacks fed up with slow service in cafes would shout out “bistro” – the Russian word for quickly.

In Paris this year, the main word was “zaderzhka” Russian for delay. Aeroflot announced it was cancelling its order for 22 Boeing 787s. The flag carrier said that it decision was based on capacity and a new fleet strategy. The falling Russian economy and the country’s relationship with the US may also have played a part.

UT Air Aviation Group, which owns Russia’s largest lessor, is also having a tough time.

It is restructuring and looking to cut almost half of its fixed wing aircraft. The helicopter division, which operates 350 helicopters, is also having a tough time.

It offers a range of services – including missions for the United Nations – but it is most reliant on off-shore oil and gas services. It is being hit by lower oil prices, the economy and the very weak rouble (which makes foreign helicopters very expensive).

UT Air ordered 15 H175s (then EC175s) at Heli Expo in March 2011. It took delivery of the first one this year but is now looking to delay the rest.

A spokesperson for Airbus Helicopters says: “We are in discussion with UTair concerning the next deliveries and adapting to their requests and current situation.”

Subscribe to our free newsletter

For more opinions from Helicopter Investor, subscribe to our email newsletter.